Your current location is:Fxscam News > Exchange Dealers

Bitcoin has broken through the $70,000 mark once again

Fxscam News2025-07-22 15:29:15【Exchange Dealers】2People have watched

IntroductionForeign exchange eye,Foreign exchange intraday short-term trading skills,As the digital asset market continues to develop, investors remain optimistic about its long-term pr

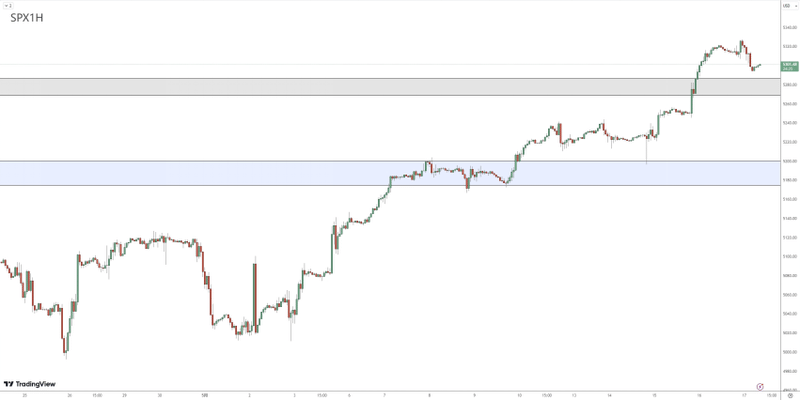

As the digital asset market continues to develop,Foreign exchange eye investors remain optimistic about its long-term prospects. According to recent reports, despite significant outflows from U.S. Exchange-Traded Funds (ETFs) last week, Bitcoin and other digital assets are still on the rise. Bitcoin briefly surpassed the $70,000 mark for the first time in over a week.

In Monday's trading, Bitcoin's price increased by 5.8%, reaching $70,014. At the same time, Ethereum rose by about 5%, while Solana and Dogecoin both saw increases of over 4%.

Last week, ETFs experienced nearly $900 million in withdrawals, reflecting continuous outflows from the Grayscale Bitcoin Trust and a slowdown in subscriptions for ETFs from BlackRock and Fidelity Investments. This performance marked one of the worst for these ten funds since the beginning of the year.

Despite the drag on ETF inflows, there has been a substantial amount of buying in the market, particularly concentrated around the $60,000 region. As the co-founder of the digital asset hedge fund INDIGO Fund stated, "This indicates the market's eagerness to buy on dips. You need to secure liquidity at lower levels to facilitate subsequent growth and generate upward momentum."

Bitcoin's avid followers seem unphased by the ETF outflows, with the market still demonstrating strong purchasing power.

Risk Warning and DisclaimerThe market carries risks, and investment should be cautious. This article does not constitute personal investment advice and has not taken into account individual users' specific investment goals, financial situations, or needs. Users should consider whether any opinions, viewpoints, or conclusions in this article are suitable for their particular circumstances. Investing based on this is at one's own responsibility.

Very good!(1472)

Related articles

- 9/26 Industry Update: Australia's ASIC delays registration for relevant providers.

- Japan's core inflation rose to 3% in December, boosting rate hike expectations.

- Trump's tariffs sparked volatility, with strong demand pushing 20

- Federal Reserve Governor: Inflation reduction carries risks, and banking regulation needs reform.

- Is Sansom Asset compliant? Is it a scam?

- Bank of Japan's rate hike talks attract attention as USD/JPY rises to 158.

- Federal Reserve Governor: Inflation reduction carries risks, and banking regulation needs reform.

- Yen nears 153 as BOJ may delay rate hikes to March, raising carry trade risks.

- BLGOTD is a Fraud: Avoid at All Costs

- The strong U.S. dollar pressures non

Popular Articles

- Renminbi's international status rises, Standard Chartered index surges towards 5000.

- RMB fluctuations reflect a stronger dollar and global uncertainties, but recovery supports stability

- 2025 Outlook: Renminbi Resilience Amid a More Rational Forex Market

- The US dollar retreated, the pound weakened, and non

Webmaster recommended

TNFL FX Broker Review: High Risk (Suspected Fraud)

The Fed may cut rates by 75bps, boosting U.S. stocks with global trends and territorial expansion.

The Fed's asymmetric rate cuts and a strong dollar may spark global economic shocks.

Analysts warned that the Canadian dollar’s rebound is unstable due to tariffs and rate differentials

[April 23, 2024 Daily Morning Market]

The Chinese yuan remains stable with a slight appreciation, but tariff uncertainties persist.

Challenges and Responses to ECB's Shift: From Interest Rate Corridor to Floor System

Pound’s plunge sparks panic, with traders betting it will drop below $1.12 to a record low.